12 California Tax Webpay Tips To Save Time

As a California taxpayer, navigating the state's tax system can be a daunting task, especially when it comes to making payments. The California Tax Webpay system is designed to simplify this process, offering a convenient online platform for taxpayers to settle their tax liabilities. However, to maximize the efficiency and benefits of this system, it's essential to be aware of several key tips and best practices. In this article, we will delve into 12 California Tax Webpay tips that can help you save time and ensure a smoother payment experience.

Understanding the California Tax Webpay System

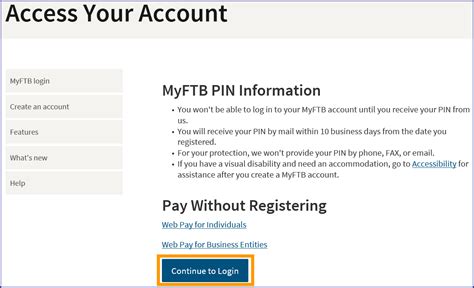

The California Tax Webpay system is an online service provided by the California Franchise Tax Board (FTB) that allows taxpayers to make payments electronically. This system supports payments for various tax types, including personal income tax, business entity taxes, and estimated tax payments. By utilizing this system, taxpayers can avoid the hassle of paper checks, ensure timely payments, and reduce the risk of late payment penalties.

Benefits of Using California Tax Webpay

Before diving into the tips, it’s crucial to understand the benefits of using the California Tax Webpay system. These include:

- Convenience: Payments can be made 24⁄7 from anywhere with an internet connection.

- Timeliness: Electronic payments are processed faster than traditional paper checks.

- Accuracy: The system reduces the chance of errors that can occur with manual payments.

- Record Keeping: The system provides a clear record of payments made, which can be useful for tax purposes.

12 California Tax Webpay Tips

To make the most out of the California Tax Webpay system and save time, consider the following tips:

1. Ensure You Have All Necessary Information

Accuracy is key when making payments through the California Tax Webpay system. Ensure you have your tax identification number (such as your Social Security number or Individual Taxpayer Identification Number) and the exact amount you need to pay. This information can be found on your tax bill or by contacting the FTB directly.

2. Choose the Right Payment Method

The system allows for payments via electronic funds withdrawal from your checking or savings account, or by credit card. Consider the fees associated with credit card payments and opt for the method that best suits your financial situation.

3. Verify Your Payment Details

Before confirming your payment, double-check your payment details to ensure everything is accurate. This includes the payment amount, payment method, and your tax identification number.

4. Make Timely Payments

To avoid late payment penalties and interest, make sure to submit your payments on or before the due date. The California Tax Webpay system allows you to schedule payments in advance, ensuring your payments are always on time.

5. Keep Records of Your Payments

It’s essential to keep a record of your payments for your tax files. The California Tax Webpay system provides a confirmation number for each payment, which you should save for your records.

6. Be Aware of Payment Limits

There are limits to the amount you can pay through the California Tax Webpay system. For large payments, you may need to use alternative methods or split your payment into multiple transactions.

7. Understand the Fees

Fees may apply for certain payment methods, such as credit card payments. Understand these fees before making your payment to avoid any surprises.

8. Security Measures

The California Tax Webpay system employs robust security measures to protect your personal and financial information. However, it’s also important for you to take steps to secure your information, such as using a secure internet connection and keeping your login credentials confidential.

9. Assistance and Support

If you encounter any issues or have questions while using the California Tax Webpay system, don’t hesitate to seek help. The FTB offers support through their website, phone, and in-person at local offices.

10. Plan for Estimated Tax Payments

If you’re self-employed or have income that isn’t subject to withholding, you may need to make estimated tax payments throughout the year. The California Tax Webpay system makes it easy to schedule and make these payments.

11. Consider Setting Up a Payment Plan

If you’re unable to pay your tax liability in full, you may be able to set up a payment plan through the California Tax Webpay system. This can help you avoid penalties and interest by allowing you to make monthly payments.

12. Review and Update Your Account Information

Finally, keep your account information up to date to ensure you receive important notices and can access your payment history. This includes updating your address, email, and other contact information as needed.

| Payment Method | Fees | Payment Limit |

|---|---|---|

| Electronic Funds Withdrawal | No fee | $100,000 per transaction |

| Credit Card | 2.3% of payment amount (minimum $1) | $1,000 per transaction |

What types of taxes can I pay through the California Tax Webpay system?

+You can pay personal income tax, business entity taxes, and estimated tax payments through the California Tax Webpay system.

How do I know if I need to make estimated tax payments?

+You may need to make estimated tax payments if you have income that isn’t subject to withholding, such as self-employment income, interest, dividends, and capital gains. Consult the FTB website or a tax professional for specific guidance.